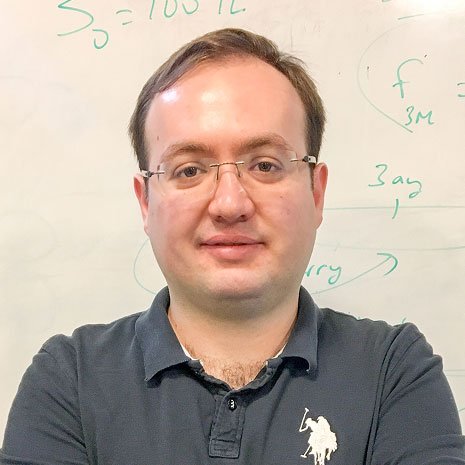

Serhat Çevikel received a BA degree in Management from Bogazici University in 1999 and PhD degree in Finance at Bogazici University Department of Management in 2023. He worked in Is Investment Corporate Finance Department between 1999-2005. During this time, he participated in many IPO/SPO, strategic restructuring, privatisation, M&A, valuation and feasibility projects. In 2004 he acted as a consultant to the Ministry of Energy and Natural Resources for an arbitration case. He was a member of the teams for the corporate restructurings of Şişecam and İşbank. The IPO/SPO projects he coordinated and/or contributed includes Vakifbank, Soda Industries and İş REIT. He contributed to the establishment of İş Venture Capital, the first venture capital company in Türkiye. The privatisation projects that he took part include TEKEL, 16 plants of Sumer Holding and 8 ports of Turkish Maritime Organization. Çevikel was a Board Advisor to Turk Telekom between 2005 and 2009. He coordinated and/or participated in Turk Telekom’s post-privatisation transition projects including tariff rebalancing, receivables restructuring, staff restructuring, company IPO and M&A’s.

Serhat Cevikel has conducted research studies and lectures in topics spanning company valuation, computer programming, management simulation, behavioral finance, algorithmic trading in financial markets and big data analytics. He has lectured Data Science, Business Analytics, Introduction to Computing, Business Valuation, Management Simulation and Money and Banking courses mainly at Bogazici University. He took part in projects including a big data analytics and GIS study for Istanbul Metropolitan Municipality, Directorate of Urban Transformation, Rapid Advisory Response for SME’s for EBRD and KOSGEB, measurement and prediction of industrial incentive effectiveness for MoIT and financial instruments modeling, valuation and simulation for Turkcell. He developed SIMULAFIN, a management simulation game for the training of business students and executive candidates.